I saw this fascinating article – Lawsuit Stunner: Half of Futures Trades in Chicago Are Illegal Wash Trades – If you go on to read the article you will read where “high frequency trading” or HFT methods use wash trades as part of standard strategy.

Anybody who trades on the ASX has seen evidence of miniscule trades for a few shares – trades that ordinary mugs can not do – mugs have to trade in minimum sized parcels. Often you can see the price for a thinly traded share changed at days end by a handful of shares traded by robots or Bots.

Experts have been critical of HFT on the ASX for years – here are just a few articles. The authorities do nothing despite complaints. Some Australian media critical of HFT from 2012 – 2013

“Black box trade suspected in stock spike”

Alan Kohler article – “Trade parasites feeding at the heart of the ASX”

“ISN claims high frequency trades cost $1.5 billion” – 4 June 13

Sounds like the dice at the casino is loaded!

Another example perhaps?

au.finance.yahoo.com/news/mysterious-stock-cynk-plummets-reopening-143252976.html

The average Joe is really the sheep who is regularly shorn until the day he goes to market.

Still burned by the Newcrest non-disclosure business. Whether it’s the chaff burners or the ASX the little bloke is really behind the eight ball.

I am interested in the COMEX metals markets too – remember there is still a twice daily gold price fix in London by the LBMA –

This is often reflected as a spike or slapdown or both on the US COMEX.

See this Kitco chart as an example of this over 3 days.

Why on earth is there any need for price fixing in these days of internet access to trading quotes – I do not know. Just bank people hanging on to some ancient privilege I would guess.

I would guess COMEX is riddled with HFT and similar “wash trade” issues being exposed at Chicago. On top of the broader issue that COMEX trades “paper gold”.

And Bob – agree it was amazing the extent that companies used to put on brokers tours and private briefings – excluding the mug punters. I suppose there is a little less of that now after the NCM crackdown. The only way HFT will be rooted out of the ASX is if enough people tell their politicians.

When the ballon finally goes up on the Paper Gold market there will probably be a return to a more physical market utterly dominated by the Asian traders especially China.

It will be a different world ( Opium Wars V2.0?)

Not clearly explained in the article is that bait trades and wash trades are opposites.

The former discovers market information. The latter produces false market information.

Wash trades are rightly illegal (don’t know if they are in Aus). But I see nothing wrong with bait trades.

Retail investors have always and will always be at a disadvantage, because professionals (people and algos) have more market information.

I also suspect that much of this activity is one algo spoofing another algo.

The problem I see with bait trades is that you or I have to trade in minimum parcels or are subject to a minimum Brokerage per trade which is commonly ~$20. While the HFT smarties can use their Bots to bombard a little stock with multiple orders for tiny numbers of shares – obviously those orders could not be subject to a ~$20 fee. The aim has to be to gain knowledge to tune their algorithms and get a trading advantage. Something not available for your average investor/trader who uses a broker or the major online trading platforms. I would like to see more of a level playing field.

Warwick,

I agree with you on uniform access to trading platforms (with appropriate volume discounts).

But any attempts to limit the use of technology to discover information is misguided and probably doomed.

My concerns re HFT are mainly two things –

[1] the hordes of miniscule ‘bot orders – that you and I are can not place because of minumum brokerage costs. Now after reading the Chicago article I suspect many of these could be “wash trades” but that’s a new issue. – and –

[2] what I read about the latency issue – where HFT actually uses faster signals – read the Alan Kohler article – HFT actually senses ordinary orders and is so much faster the HFT orders can be repositioned to take an advantage.

I would have thought against all notions of a level playing field.

Kohler –

‘What do the computers and their algorithms do? Well, as my relatively low-frequency brain can understand it, these machines constantly monitor order flow into the ASX servers, and the sophisticated programs can pick up patterns that indicate when a reasonably large order has been placed. What they then do, in effect, is “front-run” – that is, they buy ahead of the order and make a small spread selling into it.

In other words, by operating at the speed of light they can “feel” a buy order coming and can dart in front of them and ensure that the buyers pay a little bit more than they were going to, without noticing a thing.’

This isn’t front running, which would be illegal in the USA and I expect in Aus too.

In a market, those who correctly anticipate supply/demand changes make the most money. This has always and will always be true. I speak as someone who makes money doing this, although not in stocks.

As for the HFT boxes in the ASX server room. That just seems to ensure a level playing field between HFTs.

I’d say the real problem is transaction costs are too high, at least for retail investors. This is typical behaviour of a monopoly and quasi monopolies like the brokerages. But exchanges like the ASX are no longer monopolies and are losing volume to various off market platforms. While not currently available to retail investors, it seems they will be.

asiaetrading.com/hsbc-puts-retail-investor-dark-pool-on-ice/

on the internet, the incremental cost of an automated transaction is almost zero.

Perhaps you should look at fee free trading of CFDs.

I don’t know what to make of this, banks running the neighbouring economies thru corruption and fraud, spied on by Australia. Printing of plastic bank notes for SEAsia … I don’t know how the system works any more: www.cryptogon.com/?p=44566

From wikileaks.

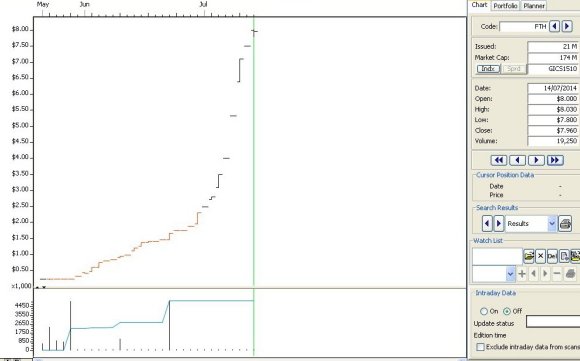

This is a fascinating and unusual example of a tiny new ASX mineral explorer – FIFTH ELEMENT RESOURCES LIMITED (FTH) – that floated about three months ago raising ~$4million. FTH has several Exploration Licences in central New South Wales.

www.asx.com.au/asx/research/companyInfo.do?by=asxCode&asxCode=FTH

FTH is famous for its booming share price which after opening in 21 May 2014 stayed around 22 to 24cents until 27 May – then started a relentless increase which ended on 14 July at $7.96 when they were suspended by the ASX after reaching a market capitalisation of $174million.

A truly stunning value as in the ~8 weeks they were trading FTH did not issue a single operational report.

So in the days before the ASX belatedly suspended them the main suspicion could have been that insider knowledge was leaking causing people to bid the price ever upwards. The ASX has “continuous disclosure” rules that mean if a company comes into possession of information that could materially affect the share price then they must release that immediately.

This is an example of a press article from around mid July. – if their shareholder numbers are so low – puzzle they ever got listed.

au.news.yahoo.com/thewest/business/a/24463113/fifth-element-under-asx-review/

Now FTH have released their Quarterly report to 30th June and clearly there is/was no hot information. Amazingly too – their consulting company continues to do work for them.

So we are left with a suspicion that the share price might have been ramped up by a series of “wash trades” – trades between the same party or parties in the know with one another.

The ASX are investigating but who would have any confidence they would get to the nitty gritty.

The issue that FTH may have never had shareholder numbers sufficient to list reflects badly on ASX listing processes – but who is surprised. However it is a red herring in terms of finding out who/what drove the share price to $8 – about 34 times what the stock might normally be worth.