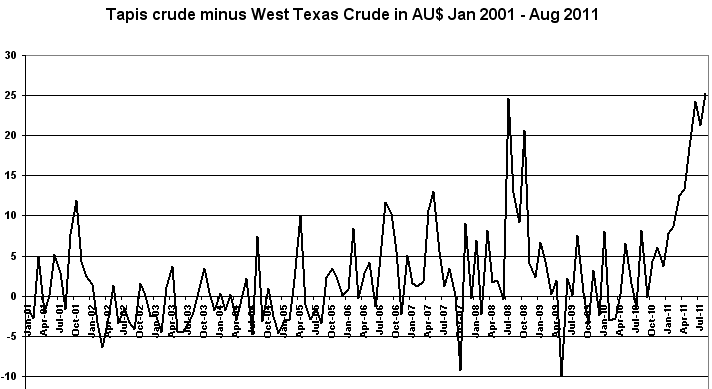

This graphic demonstrates how our useless Commonwealth Green-Labor Government is so preoccupied with its own survival – and passing their idiot Carbon Tax – that for three months now they have failed to notice how the Oil co’s are ripping off Australian families. From eyeballing the chart – at least 15c should be carved off all pump prices now.

If our Govt had any guts they would long ago have set up an Australian Fuels Corp to import tankerloads of ULP to supply service stations at fair prices.

Imagine the screams. How brilliantly successful has Oil Co PR been over the decades at conning Australian Govts and media.

All ULP prices from FuelTrac/AAA and the West Texas Crude & US vs AU$ data from Proview.

I thought that Aus petrol prices are based on TAPIS crude, which is always higher. Do you have a graph of this?

There are a few issues here nick – of course the TAPIS price is higher than than WTC. But that is not to say there is any trend in that – we simply can not know – I know of no source for downloadable TAPIS data. I would construct another graphic if you got me TAPIS data. IMHO the TAPIS price is simply a creature of the Oil co’s and they keep the time-series data secret. Just like “Singapore Mogas 95” historical time-series data is kept secret – unless you pay $thousands to Platts. As I said – “If our Govt had any guts they would long ago have set up an Australian Fuels Corp to import tankerloads of ULP to supply service stations at fair prices.” The AFC should negotiate direct with middle east suppliers – think of the AFC bargaining power.

Totally agree with you, Warren. Before the GFC, oil was $150 a barrel and the dollar was around $US0.72. The pump price was around $1.50 per litre. I know Tapis is higher than WTC but the $A is much stronger now which should affect the pump price here significantly.

If you think you are being ripped-off by a publicly held oil company, just follow the money. In the U.S. it is common for the Democrats to use Exxon as a whipping boy, but a quick glance at the annual report shows that for every $1.00 in profit that the shareholders are allow to keep the government collects $2.50 in taxes and royalties.

Disclosure:

I own 60 shares of XOM and collect $112.80 (U.S.) in dividends every year.

Warwick, there are sites with Tapis data (Malaysian Tapis Blend 44):

and:

This one has the lot – “World Crude Oil Prices”:

Thanks Paul for that link to the US site with Tapis data downloadable – a relatively recent addition there I think. I see that Tapis price has exploded this year compared to WT Crude.

Just bears out what I say – we are suckers not to have a National Fuels Corp that could always be sourcing the best deals for Australian motorists.

That graph says to me that China is locking up supplies. In anticipation probably of disruption of Gulf supplies.

Warwick

When do you think the media is going to start looking at the coal to gas/ gas to liquid technology?

I made a “dinner table comment” to a senior coal geologist about relative costs & the large coal resources in Aus. This was framed with reference to the ridiculous crude prices just prior to GFC (1). The response, which I can only imagine, was well informed was to the effect that we (Aus) could produce diesel & naphtha (kerosene jet fuel) at a barrel equivalent significantly under $100 per barrel.

Later I threw out a query on JoNova which was answered by Richard Courtenay about specifics. Richard was himself responsible for a trial GTL plant built in Wales for the Thatcher Government. He was not specific about prices but stated the project was shut down as it may have had a detrimental effect on the market price of Brent Crude.

You would never hear our current government talking about GTL in the mix for energy security.

Forget gas to liquids. Every petrol vehicle and most of the diesel vehicles in Australia could run on NG. The real scandal is that there are 100,000s of vehicles in Australia that run on NG and 99% of them have been adapted after manufacture.

Why aren’t we forcing the vehicle manufacturers to build NG vehicles?

Warwick,

I just came across this post. You need to be very careful about the price you are using to measure “world crude prices”. In particular, there is a real problem with using West Texas prices right now in that there is a bottleneck getting crude out of Cushing Oklahoma (where WTI is priced). If you look at the EIA web site, for example, you will see that WTI is selling at a large discount to Brent.

The problem is that our friends the Greens are stopping the building of extra pipeline capacity to get crude from Oklahoma to the Texas Gulf Coast where the huge refinery capacity is located. They are doing this in a misguided attempt to throttle production from the Canadian oil sands — on the grounds that it is “dirty”, that is, produces more CO2. Hence, you have right now production from Canada, the Bakken shale in North Dakota, and the resurgence of production from West Texas all trying to make its way to the Texas Gulf Coast. There is a proposal to build extra pipeline capacity but the Greens have lobbied the Obama administration heavily to stop that (Hansen was recently arrested for taking part in such a demonstration).

More generally, I would be very wary of promoting the idea that Australian consumers would be better off relying on Canberra politicians and bureaucrats to get them a better oil market outcome than the oil industry.